*The op-ed below originally appeared in Morning Consult on Tuesday, October 16, 2018

One of America’s major strengths when it comes to the economy and global trade is our petrochemical industry, which produces the building blocks used in manufacturing supply chains across the globe.

Abundant feedstocks of domestic natural gas and oil, a highly skilled workforce, a competitive tax code, and the most technologically advanced operations in the world make the United States a sought-after destination for new petrochemical manufacturing facilities to feed growing global demand. However, much of that opportunity is in jeopardy if access to global markets is hindered through tariffs on goods between China and the United States.

The administration’s decision in August to impose tariffs on a range of chemical and energy products from China was met with reciprocal tariffs on $5.45 billion worth of our industries’ products (which represents a significant portion of U.S. exports to China). The subsequent U.S. proposal for additional tariffs of up to 25 percent on $200 billion worth of Chinese goods only extended the trade conflict, and China responded by proposing yet another round of new tariffs. As this trade war escalates, the risk of further retaliatory measures that undermine our economy and blunt our competitive edge as an optimal site for petrochemical development is very real.

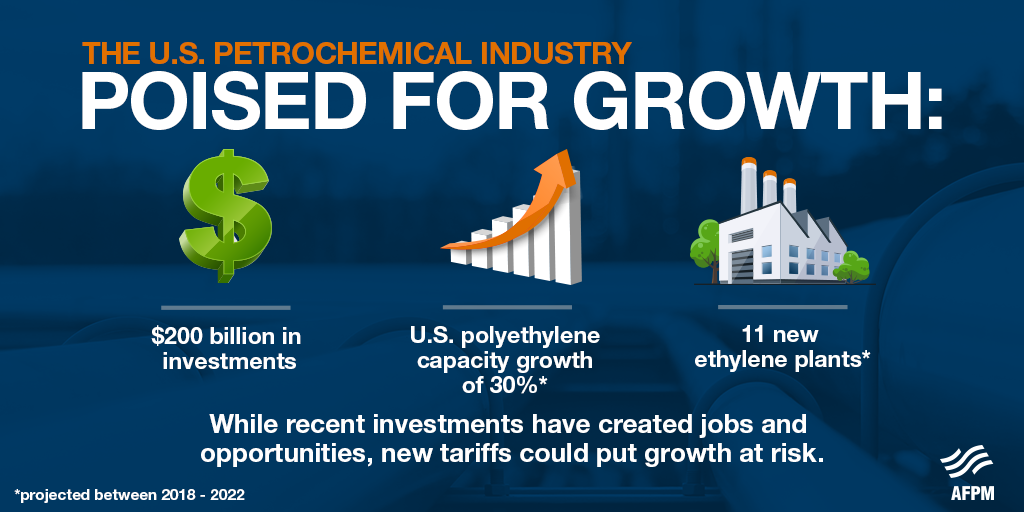

Nearly $200 billion in investments have been announced for new U.S. chemical manufacturing in recent years. Eleven new ethylene plants are expected between 2018 and 2021, and U.S. polyethylene capacity is expected to grow by more than 30 percent between 2018 and 2022.

Much of this capacity-build was anticipated to satisfy increased export demand, with the bulk of demand growth for petrochemical products expected to come from Asia and China in particular. However, the United States must have market access if we are to collectively reap the benefits of meeting Chinese petrochemical demand.

A specific example of how the tariffs stand to hinder U.S. opportunity can be found in high-density polyethylene, which is used in the manufacturing of products ranging from milk jugs and food storage containers to health care products and water-piping infrastructure. Nearly a third of U.S. HDPE exports are currently shipped to China, and exports of HDPE are expected to grow an additional 94 percent by 2020 unless inhibited. If the United States is to fully realize the benefits of growth in production capacity for HDPE and other petrochemical products, the ability to export to vital markets around the world, including China, will be essential.

American petrochemical manufacturers certainly recognize the need to hold other nations accountable for violations of international trade rules and share the administration’s concerns with China’s inadequate protection of intellectual property; however, we also support free and fair trade, as well as policies that promote market access and enhance competition.

Simply put, the U.S. refining and petrochemical industry does not require protective tariffs, and in fact, such tariffs put major investments in U.S. petrochemical projects at risk to the extent they result in the imposition of retaliatory tariffs by China. The best way to support U.S. manufacturing is to ensure global markets remain open and competitive for U.S. businesses.