Often overlooked in the compendium of efforts toward a cleaner vehicle fleet are bold, industry-led innovations inefficient liquid fuels, vehicle designs and internal combustion engines that continue to dramatically reduce tailpipe emissions.

Building on decades of broader efforts alongside automakers to advance fuel-efficient technologies and vehicles, refiners are leading the effort to transition the U.S. to high-octane gasoline to boost efficiency, and in doing so reduce carbon emissions by an amount equivalent to taking hundreds of thousands of vehicles off the road each year.

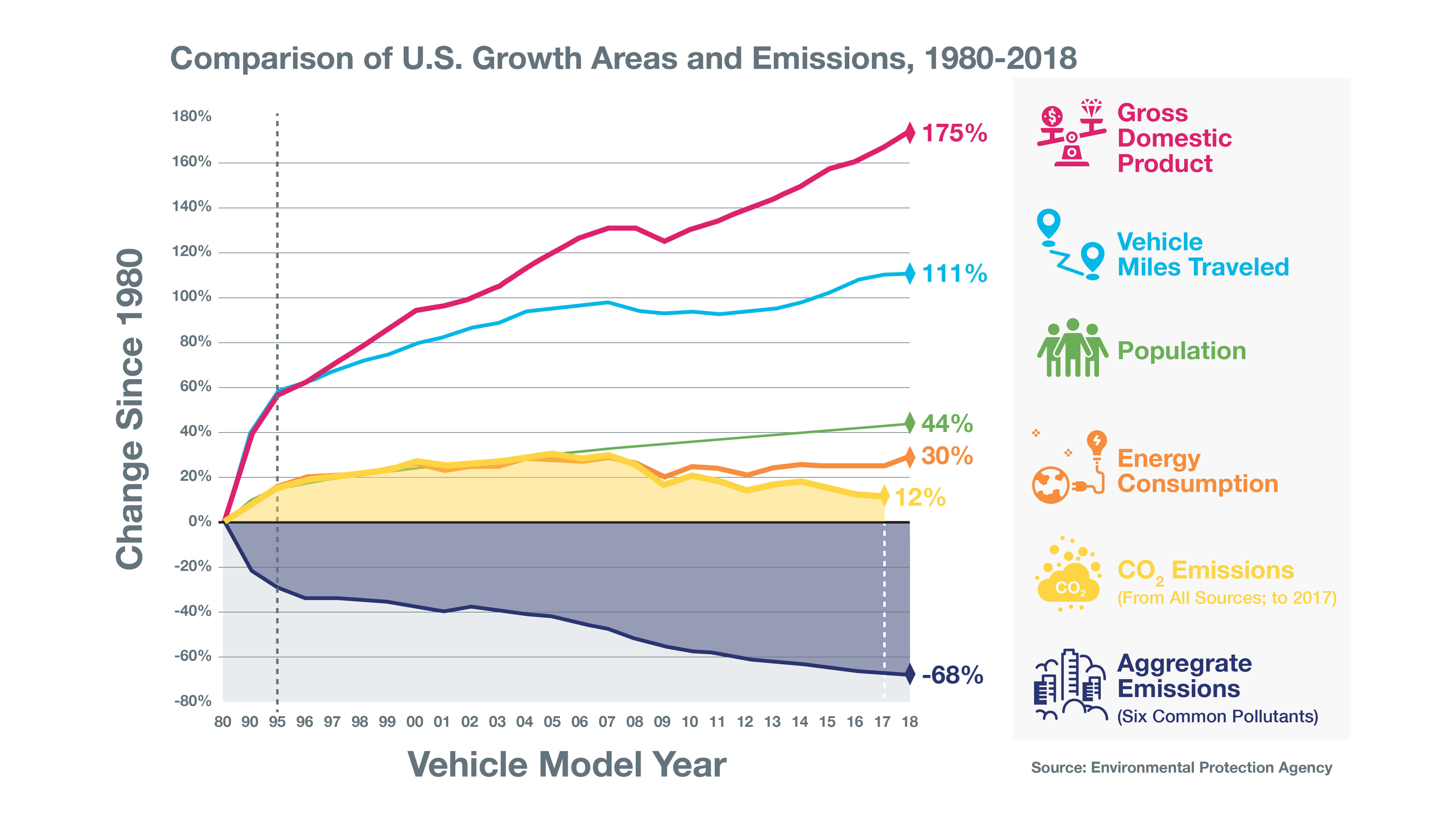

More fuel-efficient engines and vehicles have contributed to a more than 100-percent increase in vehicle miles traveled between 1990 and 2018, while CO₂ emissions from all sources rose by just 12 percent in roughly the same period, according to the U.S. Environmental Protection Agency.

The goal is to enact a nationwide high-octane, 95-RON fuel standard that would meet the most stringent air quality standards in every state, including California, while delivering efficiency gains of three to four percent — far more than the fractional improvements that typically come with vehicle design changes.

The standard would “reduce [carbon dioxide] emissions more cost-effectively for consumers than other options available,” American Fuel & Petrochemical Manufacturers President and CEO Chet Thompson told a U.S. House Energy and Commerce subcommittee in December 2018.

The high-octane, 95-RON fuel would be added to pumps alongside existing fuel options, and when used in optimized engines would allow vehicles to travel farther on each tank of gas less expensively than other options.

Congress has explored implementing the new high-octane fuel standard in 2022 as an improvement over current requirements such as the Renewable Fuel Standard, which mandates ethanol use in gasoline. The proposed rule changes coincide with automakers’ efforts to diversify powertrains, making smaller engines that rely on turbocharging to increase output. Using the new fuel, carmakers can tune engines for higher compression, which boosts power while cutting emissions.

In the Chevron Engine Lab at the company's Richmond Technology Center in California, engineers, ASE-certified mechanics, technicians and other experts blend fuels and lubricants, build and tear down engines, run vehicles and facilitate experiments testing new ways to help engines run more efficiently.

“If we really want to address CO₂, it’s super important to address fuel as part of the system,” said Dan Nicholson, General Motors’ vice president of electrification, controls, software & electronic hardware. “The fuels really need to go together with the vehicles and with the engine. It’s time to take a look at the fuel for the next generation of low CO₂-emitting gasoline engines, and high octane has to be a part of that.”

While automakers continue to develop electric vehicles — whose manufacture emits carbon dioxide, as does the generation of power to charge EV batteries in many cases — most observers believe the internal combustion engine will remain dominant on the road for decades, for a variety of reasons including cost and consumer acceptance. The U.S. Energy Information Administration, for example, projects that 80 percent of U.S. new vehicle sales in 2050 will be vehicles with internal combustion engines.

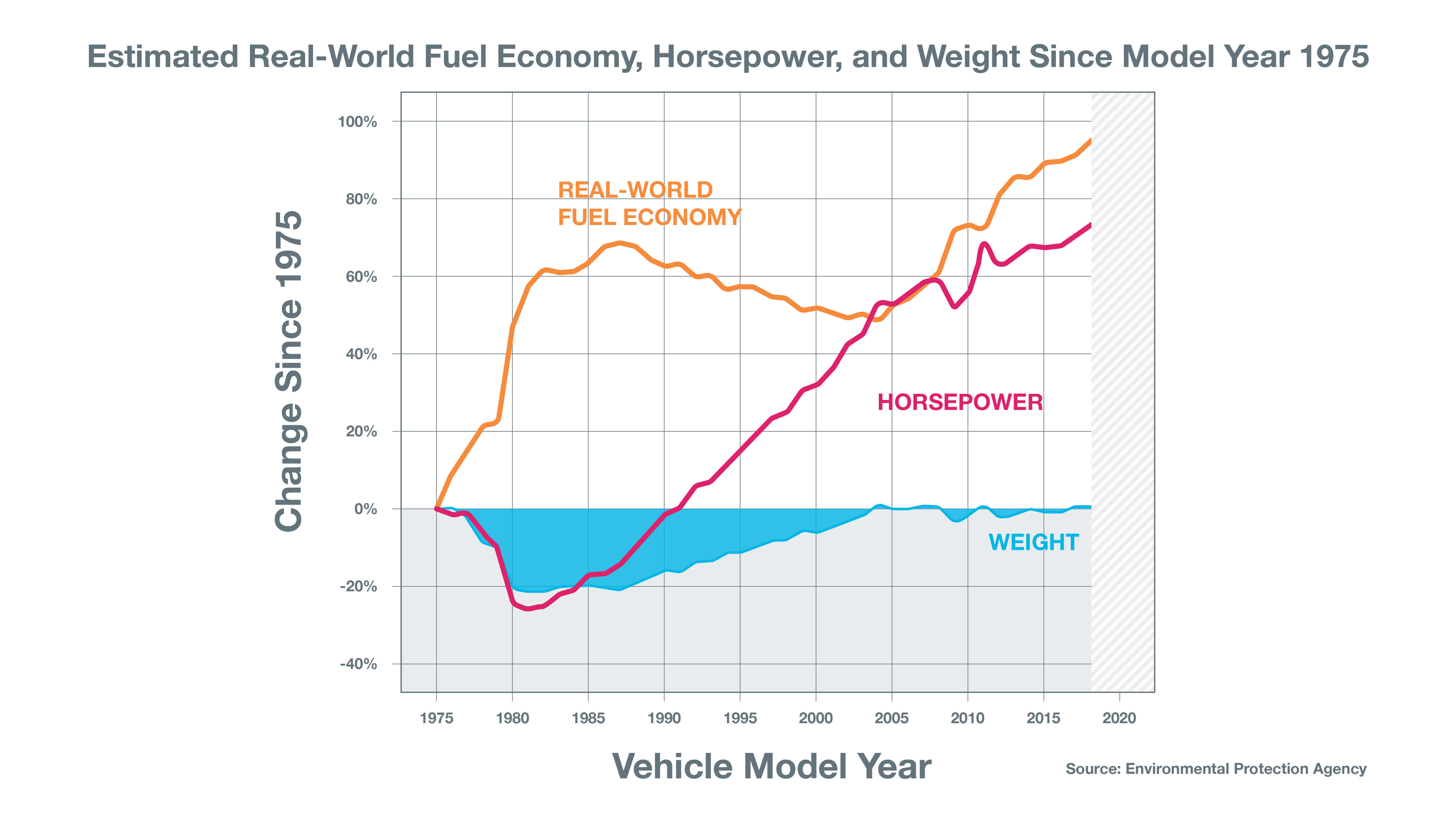

Improvements in internal combustion engine vehicles — and the fuels and oil they run on — have already paid big dividends. From 2004 to 2017, vehicle CO₂ emissions decreased 23 percent and fuel economy increased 29 percent, according to the U.S. Environmental Protection Agency (EPA), meaning today’s bigger cars, trucks and SUVs are travelling about 5.6 miles more per gallon than cars from the last decade. During this same time horsepower increased 11 percent, demonstrating that technology is allowing companies to meet consumer demand while also improving the environment. Electric vehicles represented less than one percent of auto sales during this time period.

The weight of recent vehicle models is similar to the weight of model year 1975 vehicles, but today’s vehicles have significantly better fuel economy and more horsepower than their 1975 counterparts. Between 2004 and 2017 alone, vehicle fuel economy increased 29 percent, according to the U.S. Environmental Protection Agency.

While it will cost the industry to make modifications to produce the new, higher-octane fuel at a national scale, initial production can begin quickly at some refineries using existing hardware, enabling a consistent rollout nationwide, AFPM’s Thompson said.

Along with higher octane fuels, refiners and petrochemical companies are also helping automakers produce more fuel-efficient engines and vehicles through improvements in engine oils and lightweight plastic and composite components.

While fuel is the most obvious contributor to fuel economy, motor oil also is critical. Viscosity, or the thickness of the oil, is the critical factor in reducing engine wear and can also be an impediment to increasing fuel efficiency.

“Viscosity is the real drag,” said Mark Sztenderowicz, global manager of product development for automotive engine oils at Chevron’s Oronite lubricant additives division. “Moving a thicker fluid takes more energy. If you reduce viscosity, less energy is consumed in the moving parts and in pumping the fluid around the engine.”

In the early 1990s, most car engines required oil grades such as 10W-40 or 5W-20 — with the lower number representing a lower viscosity. Newer formulations, such as 0W-20 and 0W-16 have even lower viscosity. Motorists could see an improvement in fuel economy just by switching from 10W-40 to 0W-20, Sztenderowicz said.

As refiners and chemical companies have focused on making fuel and motor oils cleaner and more efficient, petrochemical manufacturers have turned their attention to car components in the quest for higher fuel economy. The EPA estimates that every 100 pounds of weight removed from a vehicle increases fuel economy by 1 percent to 2 percent.

Advanced composite — fiber reinforced plastic — components have become essential to controlling vehicle weight as consumers demand more gadgets and power from their cars. LyondellBasell works with automakers and suppliers to develop state-of-the-art compounds used in components that are as strong as steel, but far lighter. For example, Jeep replaced the steel liftgate on its Cherokee with a plastic one for the 2019 model year, saving 12 pounds of weight.

LyondellBasell works with automakers and suppliers to develop state-of-the-art compounds used in vehicle components that are as strong as steel, but far lighter. For example, Jeep replaced the steel liftgate on its Cherokee with a plastic one for the 2019 model year, saving 12 pounds of weight.

“Our innovation teams continuously partner with tier 1 molders and original equipment manufacturers — OEMs — to unlock light-weighting opportunities in vehicle design,” said Neil Fuenmayor, market development manager for automotive products at LyondellBasell.

LyondellBasell is also helping to develop components that don’t require painting, which reduces paint shop emissions at auto plants and improves the recyclability of components, Fuenmayor said.

The improvements in lubricants and vehicle light-weighting, combined with enhanced engine design and high-octane fuel, are essential in developing cars that run more efficiently and safely, creating the most cost-efficient and consumer-friendly pathway to cleaner air.