Ethanol demand is higher than ever while waivers have helped contain RFS compliance costs

A great deal of misunderstanding persists about the impact of small refinery exemptions (SREs). Some voices continue to push a narrative that relief exempting qualified small refineries from Renewable Fuel Standard (RFS) compliance costs has destroyed ethanol demand and led to the idling and closures of several plants. Such blanket claims are wrong. In fact, the impact of SREs has been overwhelmingly positive for U.S. consumers and critical for many manufacturing facilities that produce the fuels that power America’s economy.

To have the honest discussion Americans deserve about the RFS, we need to acknowledge three things:

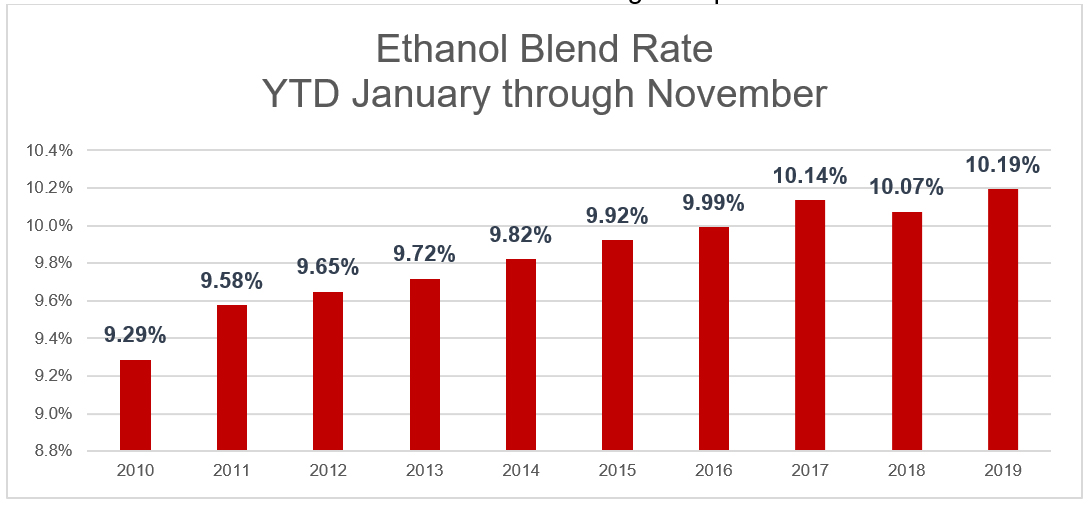

- U.S. ethanol consumption reached all-time highs in 2019

- Official EIA data shows ethanol blending and consumption reached record highs in 2019. Demand has not declined in the wake of SREs. It’s gone up.

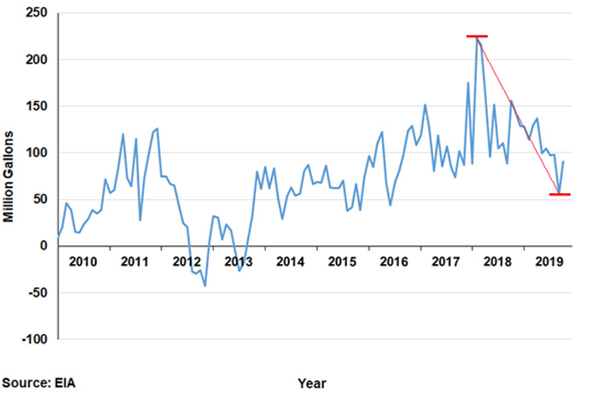

- U.S. biofuel production has gone down

- The reason for these declines isn’t a “lost market” for ethanol here at home. It’s because production ramped up in 2017 and 2018 on the expectation of growing exports to China, Mexico and Brazil — growth that never materialized while overall exports fell. Biodiesel experiences a severe price disadvantage in the market costing as much as $1.50+ more per gallon than petroleum diesel, and the lapsed federal biodiesel tax credit (which has now been reinstated) likely contributed to lower production as well.

Net U.S. Ethanol Exports

- It is impossible today to absorb 15 billion gallons of ethanol into U.S. gasoline

- Congress set RFS biofuel blending targets in 2007 with an expectation that the U.S. would be using 160+ billion gallons of gas this year. We’re using about 20 billion gallons less. With lower fuel consumption and lack of consumer interest in higher ethanol content fuels (E15, for example), it’s impossible to sell a full 15 billion gallons of ethanol to U.S. drivers. Erasing small refinery exemptions won’t change that.

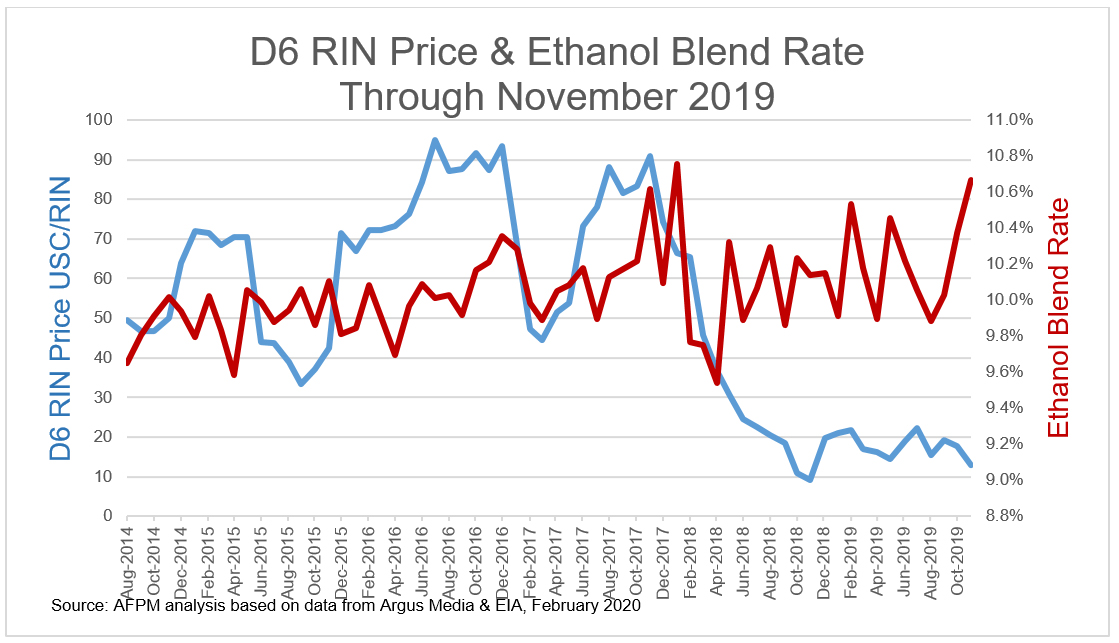

Congress created small refinery exemptions at the outset of the RFS to provide relief when the mandate can’t be achieved and compliance costs soar. Exemptions don’t reduce demand for competitively priced biofuels like ethanol. They provide vital savings for facilities that would otherwise have to purchase second-hand credits or import foreign biodiesel to satisfy the law. Waiving those burdensome compliance steps amounts to real savings for refineries and consumers.

The larger the RFS mandate, the bigger the frenzy is for second-hand RIN credits. SREs protect against RIN scarcity and price spikes without reducing actual demand for ethanol.

The record is clear that ethanol consumption has grown while SREs have worked to contain RFS regulatory costs for all refineries.