We get it. If supply and demand are what determine gasoline prices, you would think mandatory storage of even more gasoline in California might help to keep prices lower for consumers. But it’s not that simple. In fact, mandating that refiners keep significant volumes of gasoline in inventory ALL THE TIME is a recipe to raise everyday fuel costs in the California market and potentially reduce supplies of fuel available to Arizona and Nevada. And what’s worse, there’s no evidence that having more fuel in inventory would stop the occurrence of price jumps.

Take a look at the questions and answers below to better understand this issue:

What has CA proposed?

Governor Newsom has proposed legislation that would empower the California Energy Commission (CEC) to mandate that refiners maintain minimum volumes of gasoline inventory, as determined by CEC, for the purpose of mitigating price spikes. The proposal ignores the fact that the California fuel supply chain already keeps substantial volumes of gasoline inventory and that mandatory stockpiles, wherever they’ve been tried, come with significant costs and do not stop the occurrence of price volatility.

How much could this cost?

It’s impossible to answer this exactly without understanding how much gasoline storage the Governor and CEC might mandate. But making or importing gasoline to satisfy a storage mandate would be an expensive undertaking, and holding any product in storage comes with significant, ongoing costs. Further, the mandate to hold inventories at government-determined levels—supposedly until prices reach certain thresholds—would mean that product that could be going to consumers right now in California, Arizona and Nevada might be kept from the market, creating shortages and inflating costs for drivers today.

Does California keep any gasoline in storage and how often is that storage depleted?

Yes. California refiners, terminals, blenders and other participants in the fuel supply chain already keep fuel in storage—typically about two-week’s worth of gasoline and gasoline blending components, though the volume and location of product in storage will vary depending on a number of factors.

California has also never come close to emptying its gasoline supplies, even with in-state demand of roughly 33 million gallons/day. The lowest gasoline inventory recorded since 2011 was still over 425 million gallons (recorded in 2023), representing over 13-days’ worth of supply.

Will mandatory minimum inventories stop or reduce the severity of price spikes?

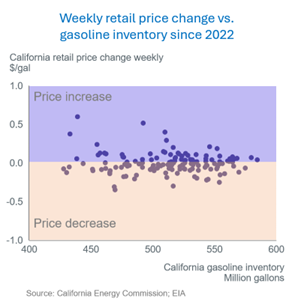

It might seem counter-intuitive, but more than a decade’s worth of California data show price swings can happen regardless of how much gasoline is in inventory. That’s because additional fuel in storage—unless it’s a massive volume—cannot, on its own, correct a fundamental imbalance between fuel supply and consumer demand. The way to correct the supply-side of an imbalance is to have sufficient local fuel manufacturing capacity, connectivity to other regional markets and access to imports.

Holding extra fuel inventories may be useful as an energy security mechanism, but not as a price-control mechanism. Inventory safeguards against the possibility of running out of fuel until additional supplies arrive or local production resumes. Inventories, even robust ones, do not stop price increases if there’s an unplanned outage at a refinery. In fact, higher prices attract additional gasoline supplies needed to balance the market.

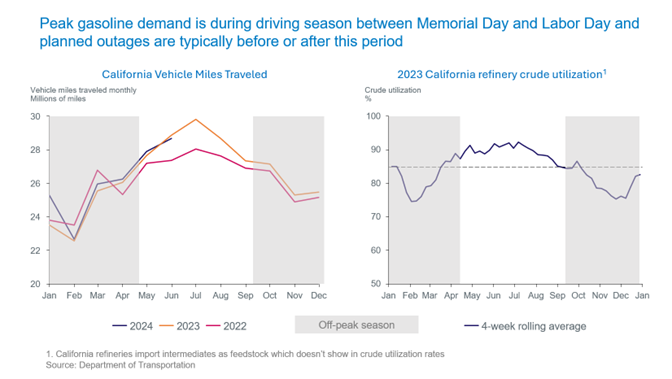

Do refiners plan maintenance for the driving season and does maintenance lead to price spikes?

No company would choose to do maintenance during the peak driving season if it could be avoided. Companies plan their largest maintenance events years ahead of time for periods when demand tends to be lower (see the charts below comparing California vehicle miles traveled—a good indicator of fuel demand—with in-state refinery utilization). Maintenance is critical to ensure facilities are able to operate safely and reliably, keeping California adequately supplied with gasoline and other fuels.

Ahead of planned maintenance, refiners make arrangements to ensure adequate supply, although unplanned outages can lead to imbalances.

What does the California Energy Commission say about stock minimums?

The California Energy Commission just published a report where they acknowledge (page 60) many potential downsides of imposing mandatory minimum inventories:

- “it may artificially create shortages in downstream markets”

- “[it] could increase average prices for refiners to maintain additional storage”

- “market equilibrium may likely emerge at a higher price level”

- “potential exists for the state to be criticized for requiring refiners to withhold fuel from the market”

If not mandatory stockpiles, what should California do to prevent price spikes?

The greatest insurance against price volatility is strong regional fuel production capacity. Unfortunately, California policies have resulted in a significant reduction in state refining capacity. This is not good for consumers.

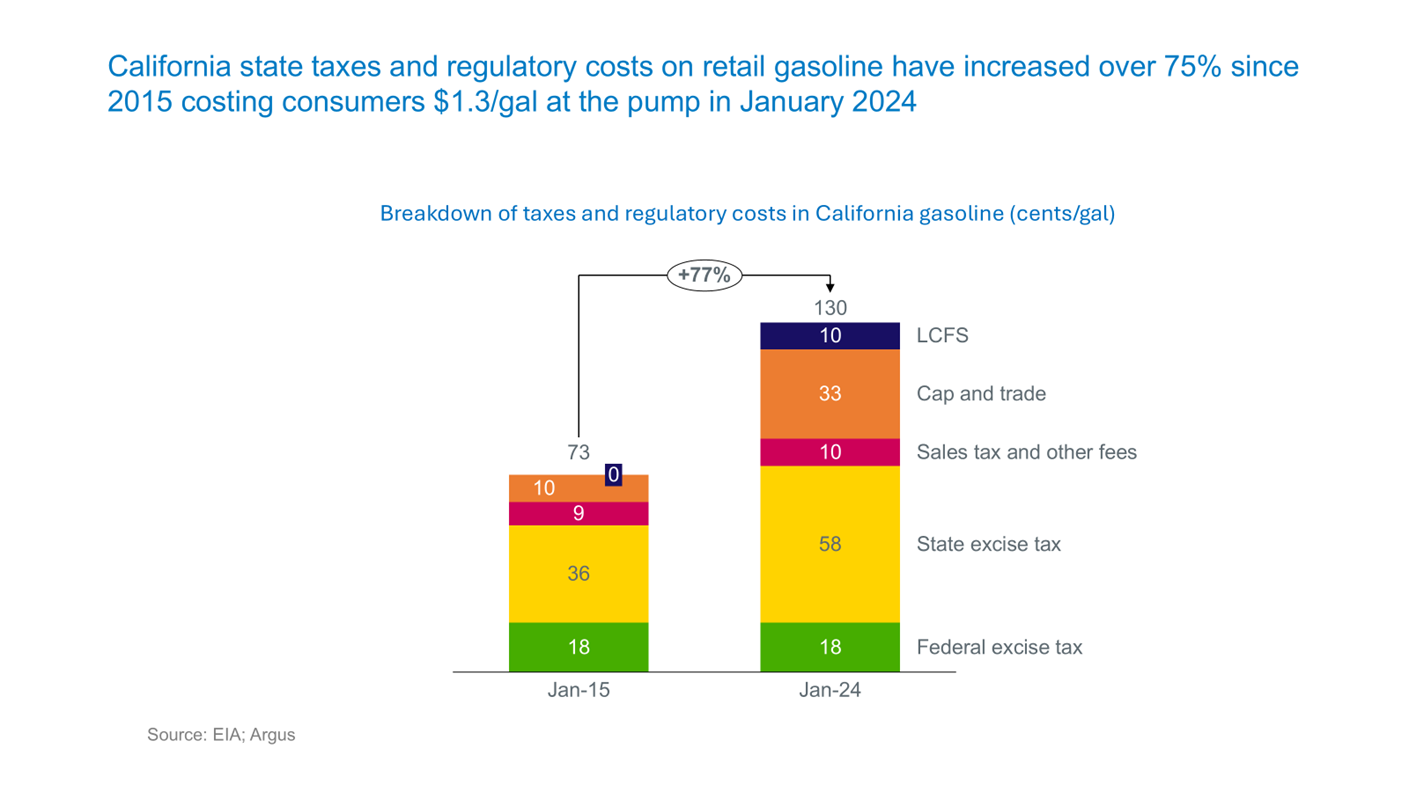

But the upside is this: if California policies compound the problem, changing those policies can also be a solution. There are steps the Governor and CEC could take today to bring relief to California drivers, starting by reducing the severity of taxes and regulations that add about $1.30 to every gallon of gasoline sold in state, a major increase since 2015 (read more here and see graph below).

And in times where supplies are tight, the Governor has flexibility to waive summertime fuel specifications that inflate gasoline production costs. He could also seek Jones Act waivers from the federal government to reduce the cost of shipping gasoline into California from other U.S. ports and simultaneously take steps to expand California’s energy infrastructure so more fuel can be supplied to the region. Regulations, set to take effect in January, that will limit California’s access to fuel and crude imports should also be postponed and revised to shield drivers from higher costs.

The American Fuel & Petrochemical Manufacturers (AFPM) is the leading trade association representing the makers of the fuels that keep us moving, the petrochemicals that are the essential building blocks for modern life, and the midstream companies that get our feedstocks and products where they need to go. We make the products that make life better, safer and more sustainable — we make progress.