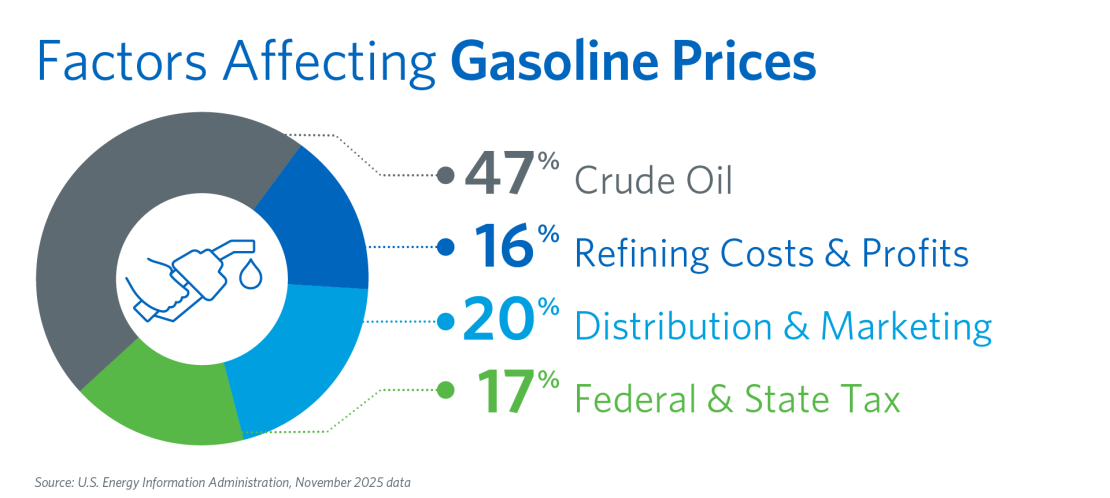

Every day, U.S. consumers purchase more than 350 million gallons of gasoline to get to work and school, to go on vacation and to see family. But what goes into the price we pay for gasoline?

1. The price of crude oil

Gasoline is made from crude oil by petroleum refineries. The cost of crude oil is the single largest input cost for making gasoline and the largest contributor to the price of gasoline at the pump.

Crude oil is a globally traded commodity, bought and sold around the world, and the price of crude oil is set by the balance of supply and demand. While there are many different types of crude oil, West Texas Intermediate (WTI) crude and Brent crude are the two most often talked about. Both Brent and WTI are traded on public exchanges as futures and options.

2. Refining costs and profits

But it takes more than just a barrel of crude to make gasoline. Refineries also incur operating costs and, as businesses, generate profits. Costs include other inputs and materials, labor, maintenance, fuel, and electricity.

Costs can vary by season and region. For example, in the summer, refiners produce blends of gasoline that better tolerate higher ambient temperatures and help reduce smog. But to make these blends, refineries must use more expensive components, which increases costs.

3. Transportation, storage, blending and retail

Refineries do not produce finished gasoline — refineries produce something called gasoline “blendstock”, to which additional components must be added to create finished gasoline that can be sold at the pump. There are costs associated with adding in those other components, as well as transportation, storage and sales at retail locations.

- Transportation — Gasoline blendstock is shipped from refineries by pipeline, ship, truck or train, and delivered to storage terminals located close to consumers. Pipelines are usually the least expensive and most efficient way to transport liquids like gasoline blendstock.

- Storage — After arriving at a terminal, the gasoline blendstock is stored in tanks that can hold as much as 10 million gallons each.

- Blending — When needed by the market, the blendstock is moved from tanks into tanker trucks where it is blended with other components, like ethanol and additives that improve fuel performance. The resulting mixture is now finished gasoline that can be sold to consumers. Ethanol is not added at or by refineries because it cannot travel by pipeline.

- Retail — The now-finished gasoline is supplied to consumers at retail outlets and to other commercial entities, like rental car agencies.

4. Federal and state taxes

In addition to the costs associated with producing, storing and transporting gasoline blendstocks and finished gasoline, federal, state and local government taxes contribute to the final retail price of gasoline.

Federal taxes include excise taxes of 18.3 cents per gallon on gasoline and 24.3 cents per gallon on diesel fuel, and a Leaking Underground Storage Tank fee of 0.1 cents per gallon on both fuels.

State taxes include sales taxes, per-gallon excise taxes (“gasoline taxes”), taxes imposed on wholesalers, environmental taxes and a variety of operational taxes. State taxes vary widely. ranging from a total of 8.95 cents/gallon in Alaska to 77.9 cents/gallon in California.

Local and municipal governments also sometimes levy taxes that can impact the price of gasoline.

The American Fuel & Petrochemical Manufacturers (AFPM) is the leading trade association representing the makers of the fuels that keep us moving, the petrochemicals that are the essential building blocks for modern life, and the midstream companies that get our feedstocks and products where they need to go. We make the products that make life better, safer and more sustainable — we make progress.