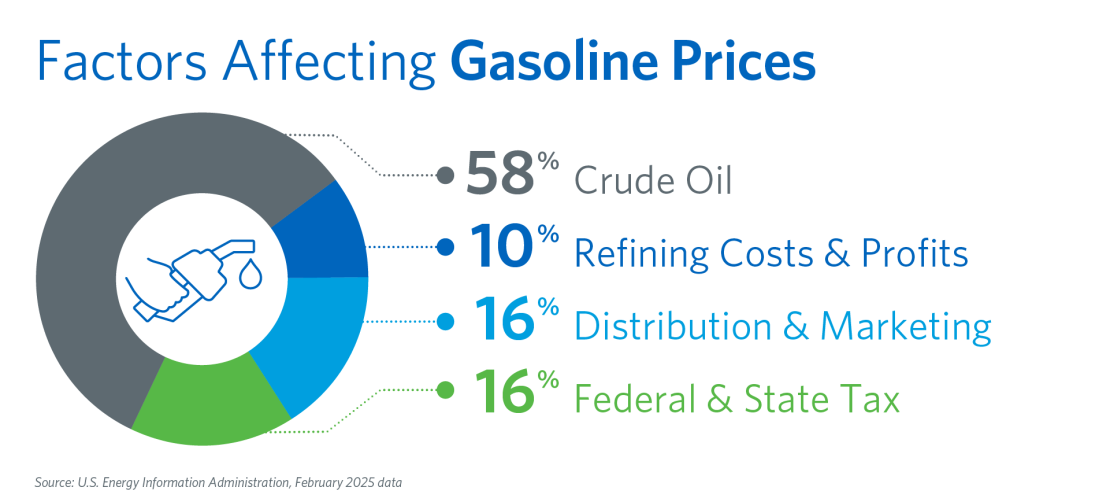

Gasoline prices are complicated and influenced by a number of intertwining factors and supply chain issues, as we’ve discussed (Energy market impacts on fuel & petrochemical prices). The cost of raw crude oil that is used by refineries to produce gasoline accounts for more than half of the price drivers see at the pump.

Crude oil is always the top contributor to the prices U.S. drivers see at the pump. Since 2000, crude oil prices have comprised, on average, 55% of the retail price for finished gasoline. Monthly data from the U.S. Energy Information Administration shows that in February 2025 the crude oil percentage was at 58% of the total retail price drivers see at the pump. Source: AFPM visual representation of U.S. Energy Information Administration data

Why is the price of crude oil so high?

Crude oil is a globally traded commodity and crude oil prices are a function of market supply and demand—both at the current moment and looking ahead.

When demand outstrips supply—as the market now expects is happening—prices rise. When supply overwhelms demand, prices fall, as they did during the height of COVID-19.

With economies reopening, global demand for crude oil and refined products has been increasing and the supply of crude oil has been challenged to keep up. Shuttered production has been slow to ramp up and expectations that shortages of natural gas in Europe will increase total demand for crude oil have put upward pressure on prices.

Oil markets are famously sensitive to uncertainty. Global conflict can send prices higher on concerns that crude oil supplies could be disrupted. This is playing out in response to Russia’s unprovoked acts of war against Ukraine. Russia is a major supplier of crude oil and other energy products globally, though less so in the United States. In recent days, many market participants have committed to stop purchasing Russian oil. Shipping companies are concerned about loading cargoes from Russia and some shippers are finding the cost associated with such cargoes too high. These moves are tightening an already tight market.

What will bring prices down?

Put simply, additional supplies of crude oil. Any supply lost from the market must be replaced for prices to normalize. Ideally, the additional crude oil will be comparable in quality to what Russia supplies in terms of viscosity (light or heavy) and sulfur content (sweet or sour). There are more than 100 types of oil produced around the world and refineries are configured differently to run best on certain types; this is known as fit-for-purpose crude slates.

The announced coordinated release of oil from the United States and other countries’ strategic petroleum reserves (SPR) should help to calm the market in the near term, provided these SPR volumes are released into the market quickly. But releasing crude from reserves is not a long-term strategy. The planned SPR releases are equivalent to 2 million barrels a day of supply for 30 days, while Russian oil exports into the global market average about 5 million barrels per day.

A long-term strategy must include increased crude oil production from countries we can count on as well as ample refining capacity (Read more on the role of U.S. refiners in the global market here).

Global demand will remain strong. Will U.S. policy match?

Recent outlooks published by the International Energy Agency (IEA) and Energy Information Administration (EIA) paint a clear picture that global energy needs are going to rise significantly in the decades to come, reflecting population growth, more nations progressing out of poverty, and the expansion of transportation and technology systems worldwide. Products derived from crude oil will continue to satisfy a significant share of this growing demand.

The world faces a dual challenge—the need for sustainable, affordable energy today and the imperative to sustainably meet the energy needs of tomorrow. This reality must be factored into our present policy decisions here in the United States. We can work to stabilize the market by:

- Upping the volumes of crude oil produced in financially and geopolitically stable, market-driven countries, including the United States

Domestic production rates can be slow to change if there is doubt about the long-term security of such investments because of political rhetoric and uncertainty around financing. Our government can do a lot to calm these concerns. - Increasing economic access to crude by making necessary energy investments and policy reforms

It should be easier for U.S. refineries to access heavy, sour Canadian oil. Pipeline infrastructure is safe and would help. Right now, West Coast refineries find it vastly more affordable to import lighter crude oil from Asia than to have the same quality U.S. crude shipped in. Jones Act exemptions and other reforms could help. - Shoring up U.S. refining capacity

The United States has the most complex and economic refining industry in the world, but we are losing capacity while the rest of the world is building. We have less refining capacity today than we did just a few years ago. At the beginning of 2020, U.S. refineries were capable of processing 18.976 million barrels of crude oil every day (BPD). In 2022, our capacity is nearly 900,000 BPD less. We’ve permanently shuttered some facilities and are converting others away from gasoline and diesel production to smaller volumes of renewable fuels. With every barrel of refining capacity we’re losing, Asia is building—and then some. Policies like the Renewable Fuel Standard that make it more expensive to manufacture gasoline and diesel in the United States, and regulatory moves to phase out internal combustion engine vehicles are hampering the strength of America’s liquid fuel industries.

The American Fuel & Petrochemical Manufacturers (AFPM) is the leading trade association representing the makers of the fuels that keep us moving, the petrochemicals that are the essential building blocks for modern life, and the midstream companies that get our feedstocks and products where they need to go. We make the products that make life better, safer and more sustainable — we make progress.