AFPM recently submitted comments to EPA in support of the Renewable Fuel Standard (RFS) general waiver petitions submitted by the governors of Louisiana, Texas, Oklahoma, Utah, Wyoming, and Pennsylvania. This post doesn’t get into the details of all the arguments being made, but it lays out some observations about the state of the RFS program and (hopefully) a better path forward.

- AFPM sees an important and growing role for ethanol (and other biofuels) in the transportation fuel mix. Our members produce nearly 20% of U.S. ethanol and are largest producers of renewable diesel in the U.S. We have no interest in keeping biofuels out of the market. Our advocacy is meant to ensure the policy is achievable, protects consumers, and maintains refinery competitiveness.

- The 2020 RFS standards were nevertheless too high. As EPA finalized the 2020 percentage standards, they departed from longstanding policy and prospectively reallocated an estimated the number of RINS they expected to grant through small refinery exemptions. At the time, that was 770 million RINs, which were factored into higher percentage standards. Of course, the 10th Circuit decision came down after the rule was finalized, and at this time the Biden Administration has not made any decisions about 2020 SREs. If the new Administration cuts down the number of small refinery relief waivers, the practical impact will have been to exceed the statutory standards. And that is clear from the data. Certainly, not all of the 770 million RINs should have been reallocated.

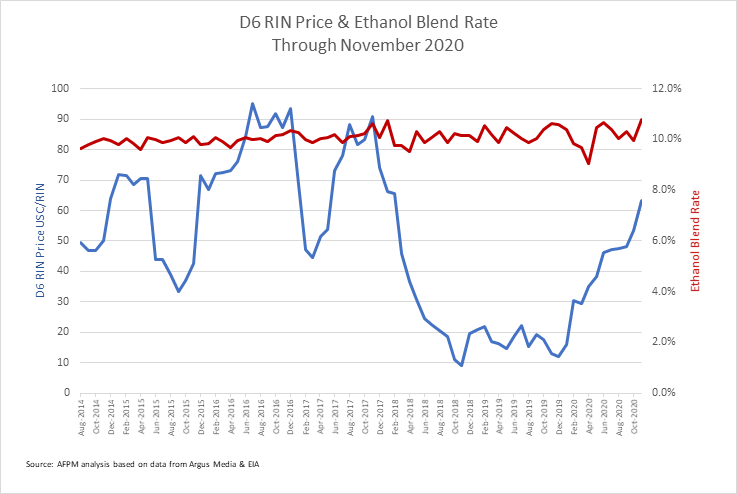

EIA published a piece just this week showing that actual RIN generation fell short of the final 2020 standards by 800 million RINs (even after accounting for the impact of the pandemic on fuel demand). It is little wonder why RIN prices are so high.

- The debate about RIN price pass-through misses the point, especially during a pandemic. As multiple ethanol organizations have repeatedly pointed out, there was a 2015 EPA memo claiming the price of RINs is passed through in the price of wholesale petroleum fuels. That finding is disputed by many refiners who experience a different reality when negotiating with marketers. But even assuming this were true during a typical year, one cannot assume pricing behavior in a pandemic is the same. As AFPM notes in our comments, through much of last year as consumer demand plummeted, refining utilization was severely reduced and there was a major oversupply of fuel products. It was impossible to pass through RIN costs with these economics. Refiners had to absorb many costs just to maintain market share. This is harmful to many refineries and the communities we serve.

- Whatever benefits the RFS may have had in establishing the ethanol industry, it is no longer an effective policy. The market for E10 gasoline is well-established and broadly recognized. Even Growth Energy acknowledged this in their comment opposing the National Wildlife Federation’s severe environmental harm petition, stating “[a]lmost all domestic ethanol consumption occurs through E10, but demand for E10 exists entirely independent of the RFS standards…” and “…the 2020 RFS standards would have at most a negligible effect on the production or use of ethanol…” (emphasis added).

As a result, refiners are paying billions of dollars for RINs generated by E10 blends. Or put differently, the cost of generating a couple hundred incremental million D6 RINs through E15 and E85 is increasing the cost of ALL ethanol blended fuels. This is not an efficient policy to get more ethanol into the marketplace and is a completely unnecessary cost.

- An octane policy paired with RFS modernization would be a better policy for refiners, ethanol producers, automakers, and the environment. Ethanol is the cheapest octane source on the planet. It is a low-carbon fuel and has beneficial blending properties. Implementing a 95 RON octane standard will increase the market value of ethanol’s best attributes, likely increasing ethanol’s market share and making the RFS (at least in its current form) superfluous. It would provide an opportunity to clean up statutory language to reduce market barriers and promote innovation. It would be the annual carbon benefit of doubling the number of EVs sold last year and help automakers with meeting fuel economy standards. AFPM would support all of these objectives.

AFPM remains ready to work with all stakeholders to find smarter policy design to reduce carbon emissions in the most efficient manner possible.