This article originally appeared on Politico.com

BAYTOWN, TEXAS – A decade ago, when Mike Zamora ran ExxonMobil’s Baytown petrochemical plant, his vision to expand the facility and boost its capacity was nothing but a pipe dream.

“There was really just very little business incentive at the time because we weren’t competitive within the global landscape,” Zamora said in a recent interview.

Now, Zamora, head of manufacturing for ExxonMobil Chemical Company in the Americas, is a key player in a petrochemical manufacturing boom of historic proportions. Zamora oversees a significant part of ExxonMobil’s plans to invest $20 billion along the Gulf Coast over 10 years through a series of projects that includes the company’s first petrochemical plant to be proposed on a completely undeveloped site in four decades. Those plans also include a new cracker on the very site he worked at in Baytown that is the first by ExxonMobil to be built from scratch in 20 years.

Zamora’s dream became a reality thanks to a plentiful U.S. supply of cheap natural gas, combined with increasing demand for chemical products from emerging markets overseas, particularly in Asia. Petrochemical facilities are capitalizing on the opportunity, tapping natural gas reserves to supply ethane, which through a process called cracking, is converted into ethylene, a key building block of plastic.

“It’s just such an awesome change in our industry,” Zamora said. “It’s not just a first wave and a second wave, but it’s shown itself to be a sustainable wave of growth.”

The benefits of the U.S. now being the largest natural gas producer in the world are well known and documented. The shale boom spawned a wave of expansions at petrochemical facilities between 2013 and 2015, particularly for fertilizer manufacturers, since natural gas can be converted into ammonia.

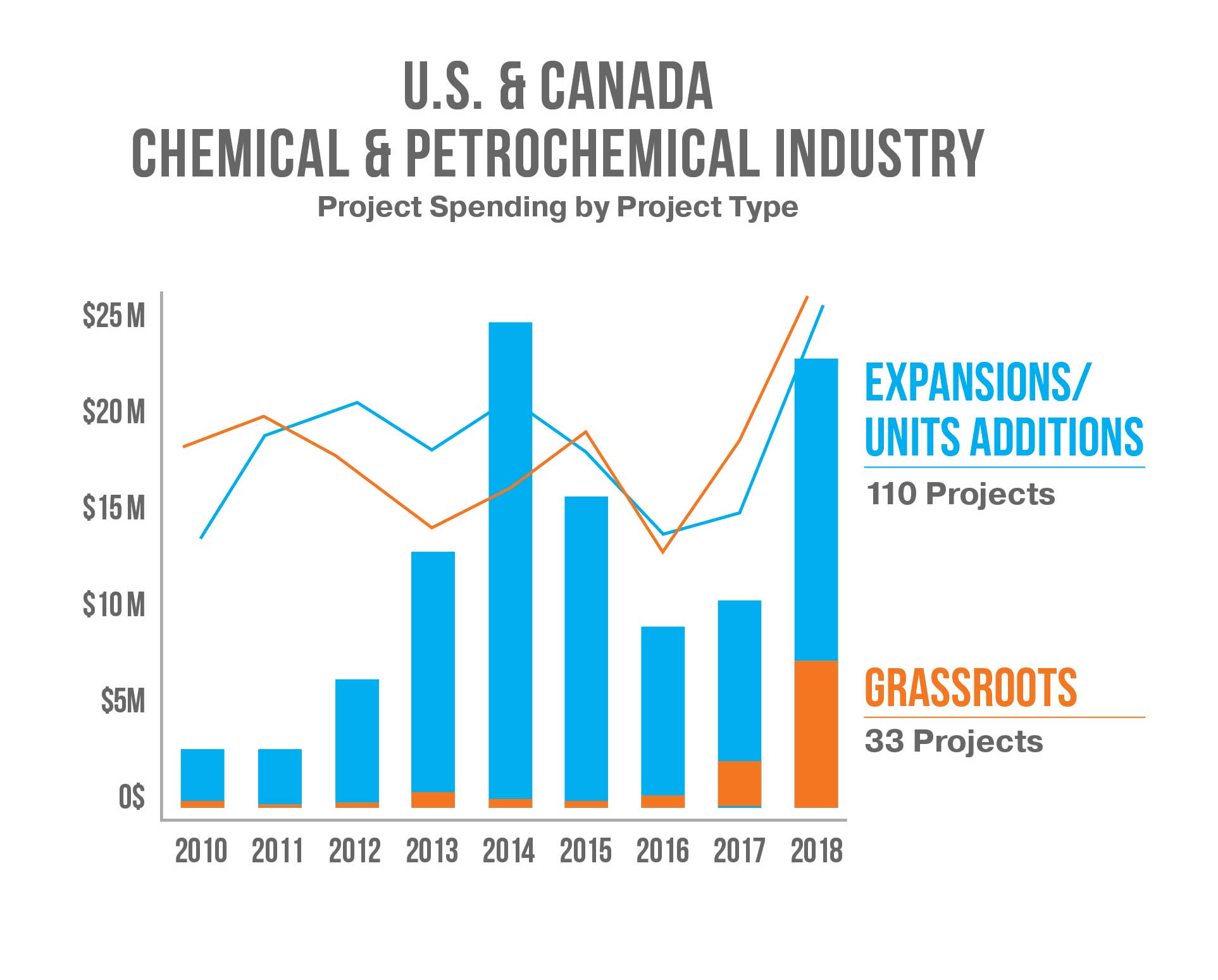

Source: Industrial Resources Info, Inc.

Less well known is that those expansions have continued. When combined with the $17.5 billion likely to be invested in 17 brand-new petrochemical facilities this year in Canada and the United States, 2018 could see the greatest number of petrochemical projects of any year since 2010, according to Texas-based Industrial Info Resources, Inc.

“The time for speculating which plants will be built or not is coming to a close, because we’re finally seeing the plants being completed,” said Kathy Hall, the executive editor and founder of PetroChem Wire, a trade publication that charts growth in the industry.

Two of the most recently completed projects are Chevron Phillips Chemical’s new ethane cracker in Baytown, which was built on a plot of land the size of 44 football fields, and two new polyethylene (PE) units south of Houston in Old Ocean, Texas. These units convert ethylene like that produced in Baytown into polyethylene, or resin pellets, that are the building blocks for a variety of plastics. The $6 billion investment was years in the making. It represented a shift in the company’s investments from the Middle East back to the United States due to the shale boom. The cracker and PE units were the first investments of this type built in the United States by Chevron Phillips in decades.

“This represents a 40 percent increase in our U.S. capacity to make ethylene and polyethylene, so that’s a huge ramp up for a company that goes back to the 1960s when we first built crackers, either as Chevron or Phillips,” said Ron Corn, senior vice president of petrochemicals for Chevron Phillips Chemical, in a recent interview.

For Corn, who moved from a post in Asia back to the United States in 2010, when the shale gas boom took off, the growth of petrochemicals became a significant part of the rebirth in American manufacturing. Chevron Phillips Chemical employed nearly 10,000 workers at the peak of construction, part of tens of thousands of high-paying jobs linked to petrochemical expansions and new facilities in recent years.

“One of the most memorable things that sticks in my mind is being at our cracker site at the end of a shift and watching 4,500 workers in hard hats and steel-toe boots kind of melt out of this huge plant, come down the central pipe rack and walk to the parking lot after a safe day,” Corn said. “That’s a whole army.”

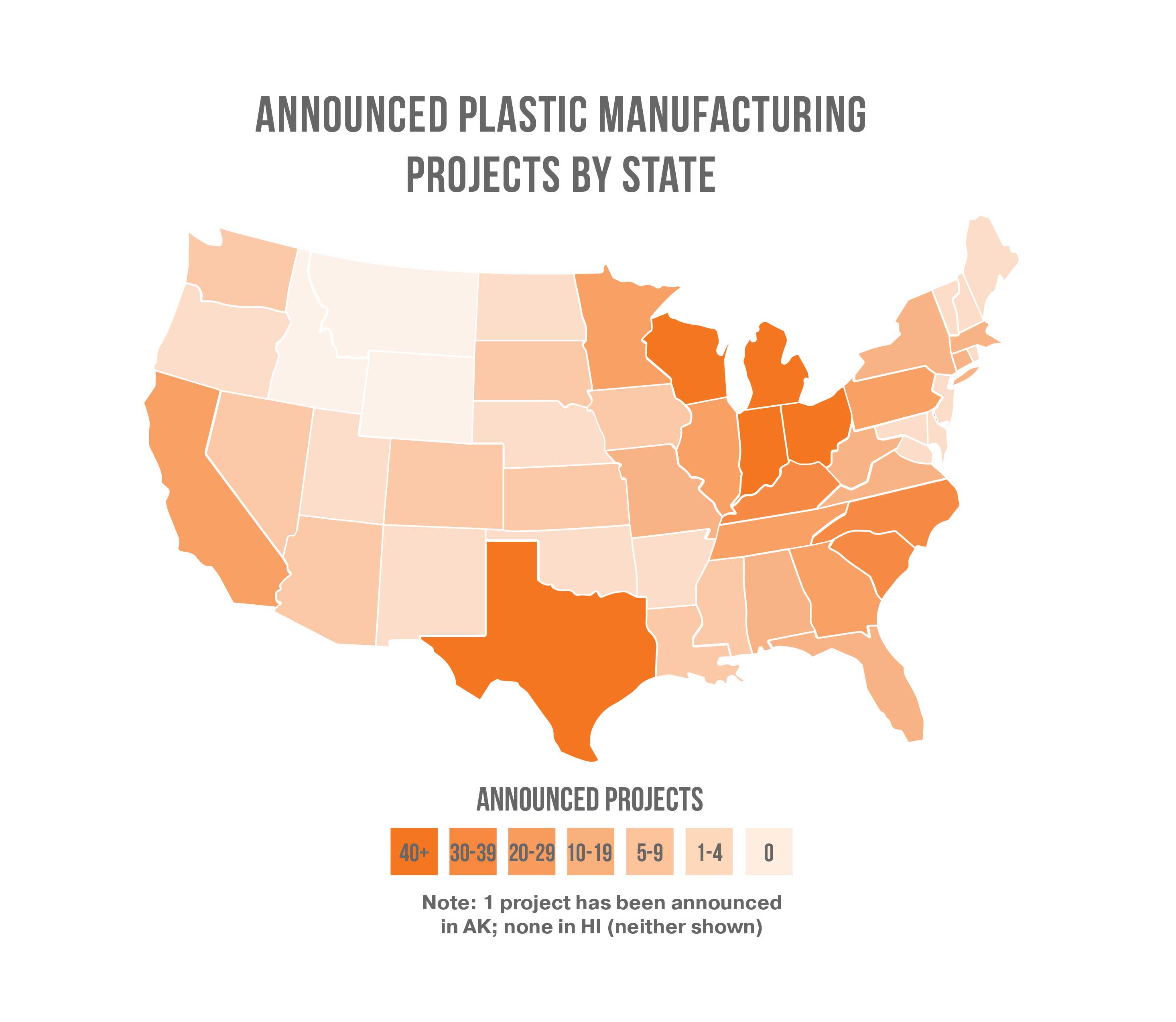

And it’s not just the Gulf Coast. The petrochemical manufacturing boom has spread to some of the hardest-hit parts of the country, such as Appalachia, where shale production in the Marcellus shale in Western Pennsylvania and Ohio has given the region an economic lifeline in the wake of job loss spurred by the decline of the coal and steel industries. Seeking to tap that plentiful gas supply, Shell Chemical Appalachia announced in June 2016 a reported $6 billion investment to build a new ethane cracker in Beaver County, Pa., on the site of a former zinc smelter.

Source: Notes on Shale gas, Manufacturing and the Chemical Industry, American Chemical Council, 2017

Unlike its Gulf Coast cousins, the Shell ethane cracker will not supply demand overseas, but demand at home — since it is located within 700 miles of the North American market for polyethylene.

“It’s been 50 years or so since we’ve made this scale of investment in chemicals domestically,” said Michael Marr of Shell Chemical, who will move permanently from the oil and petrochemical complex of Houston to Pittsburgh to help coordinate Shell’s workforce development efforts and to represent Shell’s new business across the region.

More polyethylene means more of the products that are in demand across the globe. Polyester clothing that keeps you dry and comfortable, the shrink wrap that keeps food fresher longer, and the plastic that makes cars lighter and more fuel-efficient show that polyethylene is everywhere.

“Everyday living is improved by the polyethylene we make,” ExxonMobil’s Zamora said. And much of that will be American-made.

“It’s not just how much we are spending, but where we are spending it,” Zamora added. “The fact that we’re doing that here in the United States is the biggest change, where we’d had limited investments in the recent past.”